13.6 Federal and State Responsibilities

The institution (a) is in compliance with its program responsibilities under Title IV of the most recent Higher Education Act as amended and (b) audits financial aid programs as required by federal and state regulations. In reviewing the institution’s compliance with these program responsibilities under Title IV, SACSCOC relies on documentation forwarded to it by the U. S. Department of Education.(Financial Aid Audits)

√ Compliance ____Non-Compliance

Narrative

St. Petersburg College is in compliance with its program responsibilities under Title IV of the most recent Higher Education Act as amended and conducts all financial audits required by state and federal regulations.

The College President is authorized by Florida Statute 1001.65 and the College’s Board of Trustees Rules and Procedures P6Hx23-5.906 (Disbursement Procedures) and P6Hx23-4.03 (Scholarships, Athletic Grants-in-Aid, and Student Financial Assistance) to establish and maintain Federal, State, and College-funded financial aid programs. The office of Financial Assistance administers student aid under the direction of the Associate Vice President for Financial Assistance Services and the Vice President of Student Affairs. Leadership meets regularly with staff to review programs, audit results, etc. to ensure compliance with state and federal regulations. Students can contact FAS through several methods: by phone, virtually (via Teams), A$KFA$ (our online student inquiry portal), Ask PETE, our Chatbot, or on campus at the Tarpon, Clearwater, Seminole or St. Petersburg/Gibbs campuses and the Midtown, Downtown and Health Education centers. Processes, procedures, and forms for Financial Aid services are available 24/7 to students on the SPC website Financial Aid page.

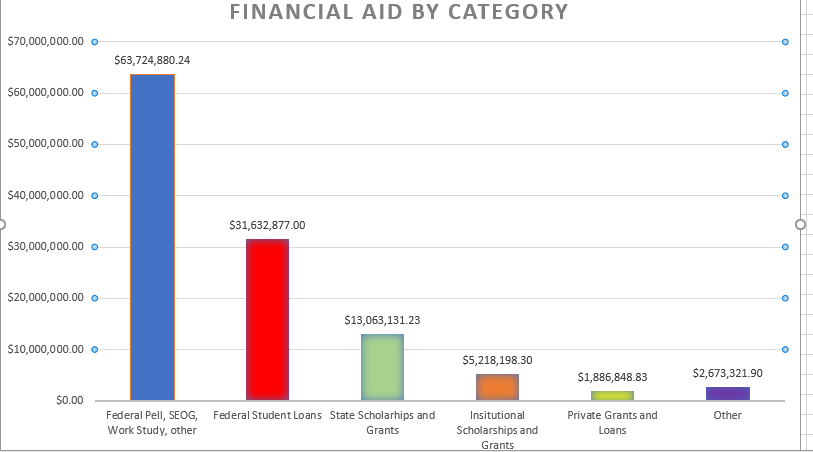

FY 2021-2022 included $118,199,257.50 in financial aid disbursements in the form of student loans, scholarships, grants, Federal work study, and other programs (Figure 13.6.1). During this time, 30,173 students were enrolled. Of these students, 25,114 (83.2 %) applied for financial assistance of some kind and 19,663 (78.2% of applicants) received an award. No differences exist in financial aid disbursement for online students. Dual Enrollment students are considered non-degree-seeking high school students and are not eligible for financial aid.

Figure 13.6.1 — Disbursements for the 2021-2022 Award Year

*Source:PowerBI

Title IV Program Responsibilities and Compliance

SPC is approved to participate in federal financial aid programs through 12/31/2025, as evidenced in the latest Program Participation Agreement (PPA) recertification and Eligibility Certification Approval Report (ECAR) received from the U.S. Department of Education on 6/16/2020. The Eligibility and Certification Approval Report (ECAR) confirms SPC’s ability to award Title IV financial aid to students enrolled in all Associate Degree programs, selected Bachelor Degree programs, and college credit certificate programs.

In addition, SPC receives advance funding for Federal Campus-Based Programs, which consist of the Federal Supplemental Educational Opportunity Grant (FSEOG) and Federal Work-Study (FWS). SPC Financial Assistance Services files the Fiscal Operations Report and Application to Participate (FISAP), which is due the last working day of September of each year. The completion and filing of the FISAP is an ED requirement for schools to continue receiving Title IV funding.

SPC does not have any issues affecting the status, compliance, or delivery of Title IV programs and is not aware of any infractions to regulations that would jeopardize Title IV funding. The College is not on the reimbursement method for federal funding and has not been obligated to post a letter of credit on behalf of the U.S. Department of Education (USDOE) or other financial regulatory agencies, any of which would indicate possible areas of non-compliance. There are no unpaid dollar amounts to the USDOE, and there is no impending litigation with respect to financial aid activities.

Federal Title IV Audit

The USDOE randomly selected SPC for an intensive Federal Program Review audit in 2022. The Final Program Review Determination Report from the USDOE (2/28/23) found no material findings with financial liabilities and one non-financial liability finding related to compliance with the requirements of the Drug-Free Schools and Communities Act (DFSCA) Amendments of 1989. The College has taken actions to correct this matter and remain in compliance with the DFSCA as evidenced by its Program Review Attestation response.

Return of Title IV Program Funds

The College is in full compliance with provisions related to the return of Title IV funds, adhering to appropriate guidelines for identifying, calculating, notifying students of, and returning unearned Title IV funds to the appropriate federal programs. Title IV funds include Pell Grants, Supplemental Educational Opportunity Grants, and subsidized and unsubsidized direct loans.

Return of Title IV funds are calculated for students who have an official or unofficial withdrawal (Table 13.6.2).

- Official Withdrawals: Students who receive federal financial aid and withdraw from 100% of their classes on or before the 60% point of the term must have their financial aid recalculated to determine any unearned financial aid amounts due to the program.

- Unofficial Withdrawals: Students who receive federal financial aid and fail to receive a passing grade in at least one course must have their records reviewed to determine any unearned financial aid or unearned fees due to the program. Failing grades are not evidence of an unofficial withdrawal and must be supported by attendance documentation.

Table 13.6.2 — Refunds to the Title IV Program 2019 – 2022

SITE MAP

Part I: Signatures Attesting to Integrity

Part II: Institutional Summary Form Prepared for Commission Reviews

Part III: Fifth-Year Compliance Certification

- Section 5: Administration and Organization

- Section 6: Faculty

- 6.1 Full-Time Faculty

- 6.2b Program Faculty

- 6.2c Program Coordination

- Section 8: Student Achievement

- Section 9: Educational Program Structure and Content

- 9.1 Program Content

- 9.2 Program Length

- Section 10: Educational Policies, Procedures, and Practices

- Section 12: Academic and Student Support Services

- 12.1 Student Support Services

- 12.4 Student Complaints

- Section 13: Financial and Physical Resources

- Section 14: Transparency and Institutional Representation

Part IV: Follow-Up Report (not applicable)

Part V: Impact Report of the Quality Enhancement Plan

Supporting Documentation

- Florida Statute 1001.65

- Board of Trustees Procedure P6Hx23-5.906

- Board of Trustees Procedure P6Hx23-4.03

- Financial Aid webpage

- Program Participation Agreement (PPA)

- Eligibility Certification Approval Report (ECAR)

- Fiscal Operations Report and Application to Participate (FISAP)

- Final Program Review Determination Report

- Program Review Attestation Response

- FY2022 State of Florida Auditor General Financial Audit Report

- FY2021 State of Florida Auditor General Financial Audit Report

- FY2020 State of Florida Auditor General Financial Audit Report

- FY2019 State of Florida Auditor General Financial Audit Report

- FY2018 State of Florida Auditor General Financial Audit Report

- FY2022 State of Florida Statewide Audit Summary Report

- FY2021 State of Florida Statewide Audit Summary Report

- FY2020 State of Florida Statewide Audit Summary Report

- FY2019 State of Florida Statewide Audit Summary Report

- FY2018 State of Florida Statewide Audit Summary Report

- BrightFutures Report

- FY2019 three-year Cohort Default Summary

- It’s My Future

- Student Rights Financial Information

** “Students processed” represents the return of Title IV funds designations that were subject to an actual return of Title IV funds; this number does not include post-withdrawal and/or over 60% of candidates.

On May 15, 2020, the Department of Education announced institutions were allowed to use waivers of Return of Title IV Funds (R2T4) requirements for students affected by the COVID-19 national emergency. As such, an institution was required to waive returns under the R2T4 requirements for any student who was determined to have begun attendance and subsequently withdrew as a result of COVID-19 during payment periods or periods of enrollment occurring during the national emergency. The use of these waivers impacted the data shown above.

Independent Audits

The College’s financial awards programs are audited annually by the State of Florida Auditor General Office in accordance with auditing standards generally accepted in the United States of America, the standards applicable to financial audits contained in Government Auditing Standards issued by the Comptroller General of the United States; and U.S. Office of Management and Budget Circular A-133, Audits of States, Local Governments, and Non-Profit Organizations. The audits included a review of Title IV Financial Aid Programs (State of Florida Auditor General Federal Audit Reports) for fiscal years ended:

- FY2022 State of Florida Auditor General Financial Audit Report: No findings

- FY2021 State of Florida Auditor General Financial Audit Report: No findings

- FY2020 State of Florida Auditor General Financial Audit Report: No findings

- FY2019 State of Florida Auditor General Financial Audit Report: No findings

- FY2018 State of Florida Auditor General Financial Audit Report: No findings

The State of Florida also publishes a Statewide Summary Schedule of Audit Findings that reviews all Florida state colleges and universities and specifically names/details those institutions that have findings.

- FY2022 State of Florida Compliance and Internal Controls Single Audit Report: SPC not included (no findings)

- FY2021 State of Florida Compliance and Internal Controls Single Audit Report: SPC not included (no findings)

- FY2020 State of Florida Compliance and Internal Controls Single Audit Report: SPC not included (no findings)

- FY2019 State of Florida Compliance and Internal Controls Single Audit Report: SPC not included (no findings)

- FY2018 State of Florida Compliance and Internal Controls Single Audit Report: SPC not included (no findings)

Public Institution Audits

St. Petersburg College provides financial assistance to students via Federal and State of Florida programs. The Florida Auditor General audits all financial aid programs annually as required by the Code of Federal Regulations 34 CFR and Florida Statutes. The Federal Financial Aid Handbook and the Federal Blue Book are sources for auditing Federal Title IV programs. The Rules of the State of Florida Auditor General Local Governmental Entity Audits is the source for auditing State programs.

St. Petersburg College participates in the following Federal Student Financial Aid programs for which audits are conducted on a regular basis:

- Federal Pell Grant

- Federal Supplemental Educational Opportunity Grant (FSEOG)

- Federal Work-Study Program (FWS)

- Federal Direct Subsidized Stafford Loan

- Federal Direct Unsubsidized Stafford Loan

- Federal Parent Loan for Undergraduate Students (PLUS)

Florida Bright Futures Scholarship program audits are conducted every two years by the FLDOE. There have been no Bright Future Findings during the last 5 years, as evidenced by the attached reports, which demonstrate the College’s adherence to program disbursement and administration.

Student Loan Default Rate

SPC’s loan default rate has steadily decreased through the efforts of outsourcing with a third-party vendor. The FY2019 three-year Cohort Default rate was 3.5%, down from 21.9% in FY 2011 as a result of the implementation of the free, easy-to-use “It’s My Future” loan management and education program and embedded IonTuition supports.

As part of our holistic approach, SPC works with IonTuition to assist students with successful student loan repayment. IonTuition is a web-based tool provided at no cost to students to allow for the management of all student loans through a single online location. Once a student registers, they will get immediate access to a personalized profile, showing their loan status, balance, payment amount, due dates, interest accrual information, and lender or servicer contacts. Students may live chat with a student loan counselor, use calculators to determine the best repayment scenario for their personal situation, create a budget, store important student loan documents, track conversations with student loan counselors, and include private loan information. IonTuition offers trained student loan counselors that can assist students in managing their student loan repayment options. Students may call Monday through Friday to speak with a counselor. To date, over 16,700 students have registered for IonTuition and over 18,000 student accounts have been resolved or cured. The Financial Aid department continues to educate students, alumni, faculty, and staff about IonTuition and aims to have the majority of students who receive student loans involved in this valuable student loan repayment program. The number of student loan borrowers has also decreased over the last three years:

- 2021-2022 – 5466 student loan borrowers

- 2020-2021 – 6652 student loan borrowers

- 2019-2020 – 8042 student loan borrowers

There have been no findings in the audits of federal awards regarding SPC’s student loan default rates.

Dissemination of Consumer Information

SPC complies with the responsibility for disseminating all financial aid and consumer information to students on the SPC Financial Assistance Services webpage and its Student Rights webpage under Financial Information.